| |

Long-Term World Oil Supply

Scenarios

The Future Is Neither as Bleak or

Rosy as Some Assert

By

John H. Wood, Gary R. Long, David F.

Morehouse

Conventionally reservoired crude oil resources comprise all crude

oil that is technically producible from reservoirs through a well

bore using any primary, secondary, improved, enhanced, or tertiary

method. Not included are liquids from mined deposits (tar sands; oil

shales) or created liquids (gas-to-liquids; coal oil). Earth's

endowment of conventionally reservoired crude oil is a large but

finite volume. Production from it may well peak within this century.

All or very nearly all of Earth's prolific petroleum basins are

believed identified and most are partially to near-fully explored.

All or nearly all of the largest oil fields in them have already

been discovered and are being produced. Production is indeed clearly

past its peak in some of the most prolific basins.

Reflecting increasing consumer demand for petroleum products,

world crude oil demand has been growing at an annualized compound

rate slightly in excess of 2 percent in recent years. Demand growth

is highest in the developing world, particularly in China and India

(each with a population in excess of 1 billion) and to a lesser

extent in Africa (0.8 billion) and South America (0.35 billion).

Where high demand growth exists it is primarily due to rapidly

rising consumer demand for transportation via cars and trucks

powered with internal combustion engines. For economic and/or

political reasons, this high demand growth component did not exist

in most of the developing world even a decade ago.

A multitude of analysts consisting of retired petroleum industry

professionals hailing from either the geologic or business side of

the house, a smattering of physicists, assorted consultants, and

less than a handful of economists have predicted at various times

over the past two decades, and with increasing frequency, that world

crude oil production would peak at times ranging from 8 to 20+ years

after their forecast. Dire effects on world oil prices, the welfare

of mankind in general, and the United States’ economy and lifestyle

in particular are typically alleged to implicitly follow the

predicted peaks. The times for many of these predicted peaks have

already come and gone, or will soon do so.

In April 2000 the United States Geological

Survey (USGS) released results of the most thorough and

methodologically modern assessment of world crude oil and natural

gas resources ever attempted. This 5-year study was undertaken "to

provide impartial, scientifically based, societally relevant

petroleum resource information essential to the economic and

strategic security of the United States." It was conducted by 40

geoscientists (many with industry backgrounds) and was reviewed

stage-by-stage by geoscientists employed by many petroleum industry

firms including several of the multinational majors.

The above facts prompted the Energy Information

Administration (EIA) to take the next logical step by providing the

first Federal analysis of long term world oil supply since that

published by Dr. M. King Hubbert of the USGS in 1974. The results of

EIA's study as presented at the 2000 AAPG meeting and published in

July 2000, remain online in slide show format at: https://www.eia.gov/petroleum/supply/monthly/.

Since then nothing has happened, nor has any new information become

available, that would significantly alter the results. High feedback

and sustained requests for "live" presentation indicate widespread

cognizance of the analysis among energy policy makers in the Federal

government, analysts who focus on energy matters, and senior

managers of public and private entities that are major consumers of

petroleum products.

Data and Methodology

EIA's long-term world oil supply analysis was done

very much in the spirit of King Hubbert's. However, it had the

benefit of a longer exploration and production history and a

geologically derived, rather than merely assumed, estimate of the

world's conventional technically recoverable crude oil resource

base. The methodology developed for the analysis also differed from

that used by others, including Hubbert, in several significant

ways:

- Although our approach is as "high-level generalized" as those

used by the other estimators, it explicitly deals in a

quantitative manner with both demand and supply, whereas others'

approaches incorporate the demand side of the world crude oil

market equation only implicitly.

- Our approach does not assume that the declining production

trend after the peak will be a mirror image of the incline prior

to the peak. While symmetry appeared to be a reasonable choice at

the time Hubbert made his estimates for the United States (which,

unlike the world, was not a closed supply-demand system) and later

elected (perhaps unfortunately) to apply the same approach at

world scale, there is no strong physical or economic rationale

that supports a symmetrical outcome for the entire world,

particularly in view of the more drawn out time scale of worldwide

development.

- Pursuant to the prior point, EIA's approach does not assume

that a single functional form can accurately model the full

production curve. Hubbert's choice of the logistic function to

model the full production curve made sense at the time he selected

it given the sparse data that were available to him at that time.

That is no longer the case. We elected to marry two functional

forms, the first of which extends production from history along a

constant percentage growth path until the production peak is

reached, the second of which declines production post-peak at a

constant reserves to production (R/P) ratio (not to be mistaken

for a constant decline rate). The estimated time of peak

production is therefore determined by the choice of these

functional forms, the rate of pre-peak production growth, the

post-peak R/P ratio, and the estimated size of the technically

recoverable resource base. EIA selected an R/P ratio of 10 as

being representative of the post-peak production experience. The

United States, a large, prolific, and very mature producing

region, has an R/P ratio of about 10 and was used as the model for

the world in a mature state.

- In concert with the USGS, our approach assumes that ultimate

recovery appreciation (field growth; reserves growth) occurs

outside the borders of the United States, albeit not necessarily

in every field. For an excellent historical example one need only

look at what has happened to projected dates of abandonment in the

North Sea over the past three decades. Others who have predicted

that the end is imminent either ignore this factor or claim that

it does not apply outside the United States.

- In fact, we believe that the USGS estimates are conservative

for a variety of reasons, chief among which are that the USGS

assessment did not encompass all geologically conceivable small

sources of conventionally resevoired crude oil and was limited to

the assessment of reserves that would be added within a 30 year

time frame because, in part, "... technological changes beyond 30

years are difficult, if not impossible, to conceptualize and

quantify." The latter limitation has clear implications for such

matters as expectations regarding field discoverability and

producibility, not to mention recovery factor improvement.

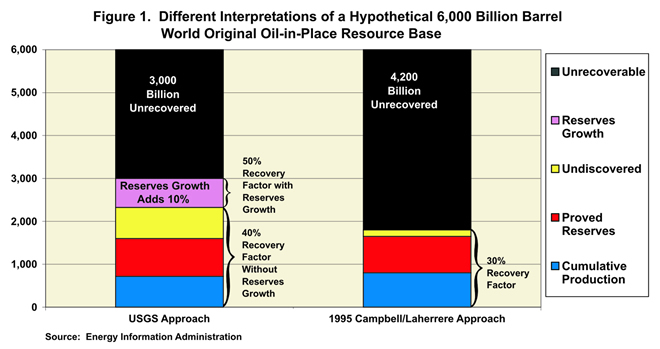

All else being equal, a larger resource base implies a later

date of peak production than does a smaller one. The significant

volumetric difference between the conventional crude oil resource

base views held by the USGS and EIA and those of most other

contemporary long term oil supply estimators is depicted in Figure

1 which compares the former to the 1995-vintage view set forth by

Colin Campbell and Jean Laherrère in "The End of Cheap Oil?"

(Scientific American, March 1998) as applied to a

hypothetical in-place resource volume.

- Last, but by no means least, we elected to explicitly

recognize the existence of uncertainty (as did the USGS resource

estimation process) by developing an approach which postulates

twelve scenarios that in toto span a wide range of

plausible variation in the inputs. Each scenario has its own

unique peak production rate and time of occurrence. Others'

approaches do not explicitly recognize uncertainty and typically

produce a solitary point estimate.

Results

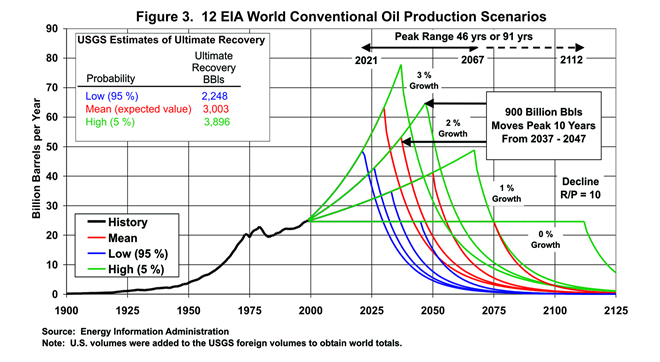

The particular scenario shown in Figure 2 depicts the 2 percent

demand growth experience of recent years extended up to the

production peak (similar to the 2.2 percent rate applied through

2020 in EIA's 2002 International Energy Outlook) and then the

decline path from the peak at a constant R/P ratio of 10. The three

divergent curves shown reflect alternative resource base volumes.

From left to right they are the sum of the USGS's United States and

rest-of-world resource estimates at the 95 percent certain (19

chances in 20 of that much or more), the statistical mean (expected

value), and 5 percent certain (1 chance in 20 of that much or more)

volumetric levels. Thus, if the USGS mean resource estimate proves

to be correct, if 2 percent production growth continues until peak

production is reached, and if production then declines at an R/P

ratio of 10, world conventional crude oil production would be

expected to peak in 2037 at a volume of 53.2 billion barrels per

year.

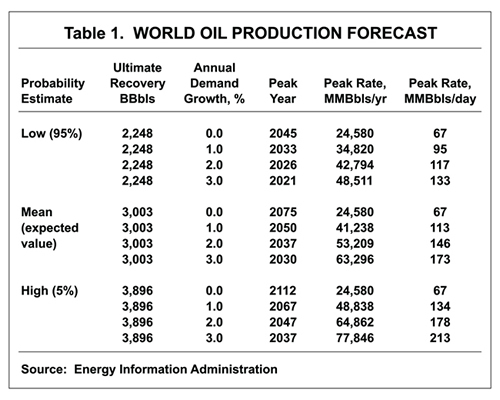

Provided numerically in Table 1 and graphically in Figure 3 are

the results of all 12 scenarios, in which the pre-peak production

growth rate is varied against the same three USGS fractile estimates

of the resource base while post-peak decline remains fixed at

R/P=10. Depending on what actually happens to demand, as well as on

how fortunate the world eventually proves to be vis a vis

the volume of its conventional crude oil resource endowment, peak

world conventional crude oil production could plausibly occur

anywhere between 2021 at a volume of 48.5 billion barrels per year

and 2112 at a volume of 24.6 billion barrels per year, though

neither of these extremes has a substantial probability of

occurrence.

Sensitivity to the estimated resource volume

These results are remarkably insensitive to the

assumption of alternative resource base estimates. For example,

adding 900 billion barrels -- more oil than had been produced at the

time the estimates were made -- to the mean USGS resource estimate

in the 2 percent growth case only delays the estimated production

peak by 10 years. Similarly, subtraction of 850 billion barrels in

the same scenario accelerates the estimated production peak by only

11 years.

It is worth noting that a 1 percent decrease in the pre-peak

growth rate has roughly the same effect that adding 900 billion

barrels to the estimated resource base does.

The bottom line

Will the world ever physically run out of crude oil?

No, but only because it will eventually become very expensive in

absence of lower-cost alternatives. When will worldwide production

of conventionally reservoired crude oil peak? That will in part

depend on the rate of demand growth, which is subject to reduction

via both technological advancements in petroleum product usage such

as hybrid-powered automobiles and the substitution of new energy

source technologies such as hydrogen-fed fuel cells where the

hydrogen is obtained, for example, from natural gas, other

hydrogen-rich organic compounds, or electrolysis of water. It will

also depend in part on the rate at which technological advancement,

operating in concert with world oil market economics, accelerates

large-scale development of unconventional sources of crude such as

tar sands and very heavy oils. Production from some of the Canadian

tar sands and Venezuelan heavy oil deposits is already economic and

growing.

In any event, the world production peak for conventionally

reservoired crude is unlikely to be "right around the corner" as so

many other estimators have been predicting. Our analysis shows that

it will be closer to the middle of the 21st century than to its

beginning. Given the long lead times required for significant

mass-market penetration of new energy technologies, this result in

no way justifies complacency about both supply-side and

demand-side research and development.

|